Are you tired of juggling numbers and receipts without the right tools? Finding the best low cost accounting software for your small business can save you time, reduce stress, and keep your finances in perfect order.

Imagine having a simple, affordable solution that helps you track expenses, send invoices, and manage taxes—all without breaking the bank. You’ll discover the top options designed to fit your budget and meet your business needs. Keep reading to find the perfect software that makes your accounting easier and lets you focus on what you do best.

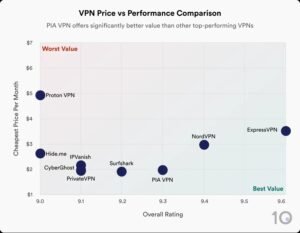

Credit: howtostartanllc.com

Why Low Cost Accounting Software Matters

Small businesses often work with tight budgets. Spending too much on accounting software can hurt their cash flow. Affordable accounting tools help manage finances without overspending. This balance is key to business growth and stability.

Low cost accounting software offers essential features without extra, costly add-ons. This makes it easier for small business owners to track income, expenses, and taxes. Simple software saves time and reduces errors. It keeps accounting straightforward and manageable.

Cost Efficiency Saves Money

Paying less for accounting software frees up money for other needs. Small businesses can invest in marketing, inventory, or staff. Affordable software still covers core accounting functions. This keeps financial management within budget limits.

Easy To Use For Non-experts

Low cost accounting software often focuses on simplicity. It uses clear menus and simple language. Business owners without accounting backgrounds find it easier to use. This reduces the need for hiring expensive accountants.

Flexible Plans Fit Different Business Sizes

Many low cost tools offer tiered pricing. Businesses pay only for what they need. This flexibility helps companies grow without changing software often. It supports small businesses at various stages.

Supports Basic Financial Tasks

Low cost software covers invoicing, expense tracking, and reporting. These features meet the core financial needs of small businesses. It helps keep records organized and ready for tax time.

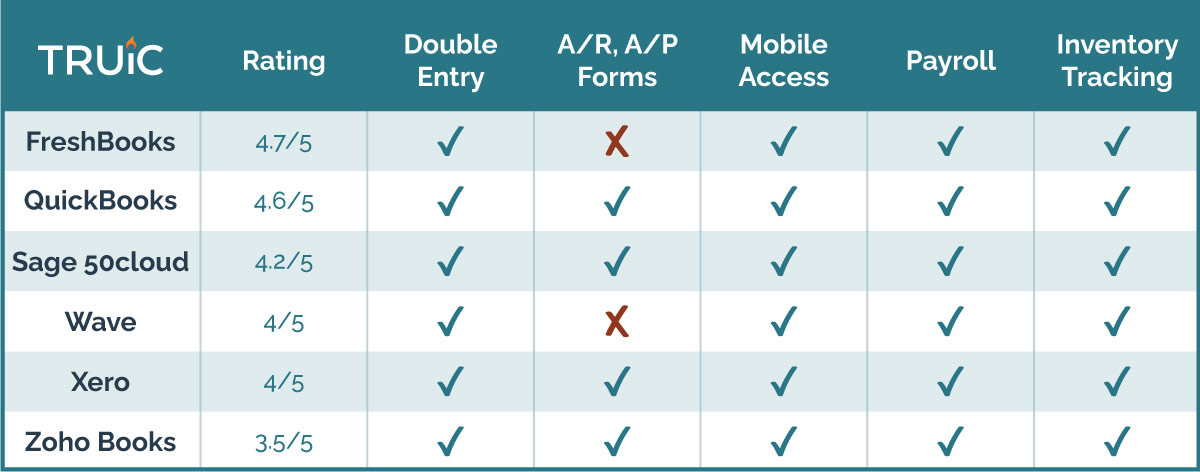

Credit: online.jwu.edu

Key Features To Look For

Choosing the right accounting software saves time and reduces errors. The best low cost options have important features to help small businesses manage money easily. These features improve daily tasks and keep finances organized. Knowing what to check can guide you to the right choice.

User-friendly Interface

Simple design helps users navigate the software quickly. Clear menus and buttons reduce confusion. Small business owners can learn to use it without extra help. A clean layout makes bookkeeping less stressful.

Invoicing And Billing

Easy invoicing tools speed up payment collection. Customizable invoice templates look professional. Automated billing reminders keep clients on schedule. Tracking payments helps monitor cash flow accurately.

Expense Tracking

Record expenses in real time to control costs. Categorizing expenses helps identify spending patterns. Uploading receipts saves paper and time. This feature keeps budgets on track effortlessly.

Tax Support

Software with tax tools simplifies filing. It calculates taxes automatically to avoid mistakes. Generating reports helps prepare for tax season. Staying compliant saves money and stress.

Mobile Access

Access your accounts from smartphones or tablets. Enter data anytime, anywhere for flexibility. Mobile apps keep you connected on the go. Managing finances outside the office becomes easy.

Top Low Cost Accounting Software Options

Choosing the right accounting software saves time and money. Small businesses need tools that fit their budget and needs. Low cost accounting software offers essential features without high fees. These options help track expenses, manage invoices, and handle taxes easily.

Here are some top low cost accounting software options. Each excels in a specific area. Find the best fit for your business style and size.

Best For Ease Of Use

Simple interfaces make accounting less stressful. Software with clear menus and easy navigation suits beginners. It helps avoid confusion and speeds up tasks. Users can manage finances without deep accounting knowledge.

Best For Small Teams

Tools designed for small teams allow multiple users. They include collaboration features and role controls. Teams can work together on accounts and reports. This improves accuracy and boosts productivity.

Best For Freelancers

Freelancers need software that tracks income and expenses quickly. The best options offer invoicing and payment reminders. They help freelancers stay organized and get paid on time. Mobile access is a plus for work on the go.

Best For Inventory Management

Businesses with stock require software that handles inventory. Good programs track product levels and sales automatically. They reduce errors and prevent overstocking or shortages. Integration with sales systems is important here.

Best For Cloud Integration

Cloud-based software stores data online securely. It allows access from any device with internet. Updates happen automatically without manual downloads. Cloud tools also enable real-time collaboration and data backup.

Comparing Pricing Plans

Comparing pricing plans is key to choosing the right accounting software. Small businesses have tight budgets. Understanding costs helps avoid surprises. Different software offers various plans. Each plan fits different business needs. Knowing these details saves money and time.

Free Versions And Trials

Many accounting tools offer free versions or trials. Free versions usually have limited features. They work well for very small businesses. Trials let users test full features for a short time. Use trials to check if software matches your needs. Always read what features are included in free plans.

Monthly Vs Annual Billing

Most software offers monthly and annual payment options. Monthly billing is flexible and easier to stop anytime. Annual billing often gives a discount on the total cost. Paying yearly saves money but requires upfront payment. Choose billing based on your cash flow and commitment level.

Hidden Fees To Watch

Some pricing plans have hidden fees. Extra charges may apply for added users or features. Support or setup fees can also increase costs. Read all terms carefully before buying. Ask about limits on invoices, transactions, or storage. Avoid surprises by knowing all fees upfront.

Tips For Choosing The Right Software

Choosing the right accounting software is important for your small business. The right tool saves time and reduces errors. It fits your budget and grows with your business needs. Here are some tips to help you pick the best software.

Assess Your Business Needs

Start by listing your basic accounting tasks. Think about invoicing, expense tracking, and payroll. Know how many users will need access. Check if you need mobile or cloud access. Match software features to your daily work.

Check Customer Support

Good customer support helps solve problems quickly. Look for software with live chat, phone, or email support. Fast responses save you stress and downtime. Support should be easy to reach and helpful for beginners.

Consider Scalability

Your business will change over time. Choose software that can grow with you. Check if you can add more users or features later. Avoid software that limits your business size or transactions.

Read User Reviews

User reviews reveal real experiences. Look for comments about ease of use and reliability. Pay attention to common issues or praises. Reviews help you avoid software with hidden problems.

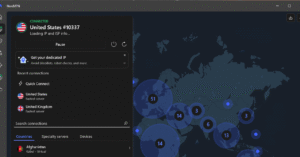

Credit: www.pcmag.com

How To Get Started Quickly

Starting with low cost accounting software is simple. Follow a few clear steps to set up your system quickly. This helps you manage your business finances without delay. Keep your process smooth and efficient to save time.

Setting Up Your Account

Create your account by entering basic business details. Use your email and a strong password. Choose your business type and currency. This helps the software tailor features for you. Verify your email to activate the account.

Importing Financial Data

Bring your past financial data into the software. Upload bank statements or spreadsheets easily. Most software accepts common file types like CSV or Excel. This step saves time by avoiding manual entry. Check for errors after importing to ensure accuracy.

Customizing Reports

Adjust reports to fit your business needs. Select the data you want to see. Change layouts to highlight important information. Set regular report schedules to track progress. Clear reports help you understand your finances better.

Frequently Asked Questions

What Is The Best Low Cost Accounting Software For Small Business?

The best low cost accounting software offers essential features like invoicing, expense tracking, and reporting. Popular options include Wave, FreshBooks, and QuickBooks Self-Employed. These tools balance affordability with usability, making them ideal for small businesses with tight budgets.

How Does Low Cost Accounting Software Help Small Businesses?

Low cost accounting software simplifies financial management by automating tasks. It reduces errors, saves time, and improves cash flow tracking. This helps small businesses make informed decisions while minimizing accounting costs and boosting overall efficiency.

Can Low Cost Software Handle Invoicing And Payments?

Yes, most low cost accounting software includes invoicing and payment features. Users can create professional invoices, send payment reminders, and accept online payments. This streamlines billing and improves cash flow for small businesses.

Is Cloud-based Accounting Software Affordable For Small Businesses?

Cloud-based accounting software is often affordable and scalable. It offers easy access, automatic updates, and data security without heavy upfront costs. Many low cost options provide flexible pricing plans suitable for small business needs.

Conclusion

Choosing the right low-cost accounting software saves time and money. Small businesses can track expenses and income easily. Many options offer useful features for simple bookkeeping. Try to pick software that fits your business needs. Keep your finances organized without spending too much.

This helps you focus on growing your business. Start with a free trial to see what works best. Good accounting tools make managing money less stressful. Simple, affordable software supports your business success.