Choosing the right accounting software for your small business can feel overwhelming. You want a tool that’s easy to use, fits your budget, and helps you keep your finances in order without extra hassle.

But with so many options out there, how do you pick the best one for your unique needs? This guide will walk you through the key factors to consider, so you can make a confident choice that saves you time and money.

Keep reading to discover how to find the perfect software that works for you and your business.

Key Features To Look For

Invoicing and Billing features help you send bills quickly and track payments easily. This keeps cash flow smooth and customers happy.

Expense Tracking lets you record all your costs. It helps to know where money goes and control spending better.

Financial Reporting provides clear reports on profits, losses, and cash flow. These reports help you make smart business choices.

Tax Compliance ensures your software follows tax rules. It helps you prepare tax forms and avoid fines.

Multi-User Access allows your team to use the software together. Each user can have different permissions for safety and control.

Types Of Accounting Software

Cloud-based solutions let you access your data from any device with internet. They update automatically and save files online. These are easy to use and good for teams working remotely. Monthly fees often apply.

Desktop software installs directly on your computer. It works without internet and stores data locally. This option can be more secure but needs manual updates. Usually, it requires a one-time purchase.

Open source options allow you to use and change the software freely. They are often free or low cost. You might need some tech skills to set up and customize. Good for businesses with unique needs.

Assessing Your Business Needs

Choosing the right accounting software depends on your business size. Small businesses may need simpler tools. Larger businesses often require software with more features. The complexity of your operations also matters. If you handle many transactions or employees, pick software that can manage this easily.

Some industries need special features. For example, retail businesses might need inventory tracking. Service-based businesses may want time tracking tools. Make sure the software fits your industry-specific requirements.

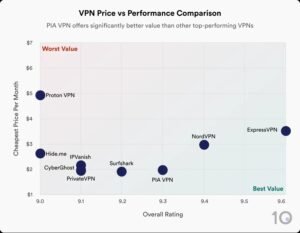

Budget constraints are important too. Find software that offers good value without extra costs. Some options have monthly fees, while others charge once. Think about what you can afford now and in the future.

Ease Of Use And Integration

User Interface and Experience should be simple and clear. Choose software with a clean design and easy navigation. This helps save time and reduces errors. A good interface makes learning fast for everyone.

Compatibility with Other Tools is key. The software must work well with your current apps like email, payroll, or inventory. This saves you from manual data entry and mistakes. Check if it connects to popular tools you already use.

Mobile Accessibility lets you manage accounts on the go. Software with mobile apps or responsive websites works on phones and tablets. This flexibility helps when away from the office or during travel. Access anytime, anywhere.

Security And Data Backup

Data encryption keeps your financial information safe. It changes data into secret codes. Only people with keys can read it. This helps stop hackers and thieves from stealing your information.

Backup options protect your data from loss. Automatic backups save your files regularly. Cloud storage is common and easy to access. External drives are another choice for extra safety. Choose software that offers multiple backup types.

Access controls limit who can see and change your data. Set strong passwords for each user. Use permissions to decide who can view or edit records. This keeps your business information safe and organized.

Pricing Models And Plans

Subscription plans charge monthly or yearly fees. They often include updates and support. One-time purchase means paying once for software. Updates may cost extra later.

Try free trials or demos. They let you test software before paying. See if it fits your business needs.

Watch for hidden costs. Some software charges for extra users, add-ons, or support. Check all fees before buying.

Customer Support And Training

Customer support must be easy to reach. Check if help is available by phone, chat, or email. Quick answers save time and stress.

Good software offers onboarding assistance. This means guides or live help to get started fast. It helps users learn without confusion.

A strong community and resources add value. Forums, videos, and FAQs let users solve problems alone. Learning from others is a big plus.

Credit: financfy.com

Popular Accounting Software Options

QuickBooks is popular for its easy invoicing and expense tracking. It works well for small businesses needing simple bookkeeping. Xero offers great cloud access and strong bank connection features. It fits businesses wanting real-time updates.

FreshBooks focuses on invoicing and time tracking. Perfect for freelancers and service providers. Wave is free and good for startups. It handles basic accounting without cost, but with fewer advanced features.

Tips For Successful Implementation

Data migration should be planned carefully to avoid errors. Start by backing up all current data. Test the migration process on a small batch first. Make sure the new software supports your data format. Keep a clear record of what is moved and when.

Staff training is key for smooth software use. Offer simple, step-by-step guides. Hold short training sessions to explain features. Encourage questions to clear up confusion. Practice with real tasks to build confidence.

Regular software updates keep the system safe and efficient. Set reminders to check for updates. Install updates during low work hours to avoid disruptions. Updates often fix bugs and add useful features.

Credit: quickbooks.intuit.com

Credit: www.score.org

Frequently Asked Questions

What Features Should Small Business Accounting Software Have?

Small business accounting software should include invoicing, expense tracking, tax calculation, and reporting. It must offer user-friendly navigation and integration with bank accounts. Automation features save time and reduce errors. Choose software that supports scalability and multi-user access for growing businesses.

How To Pick Affordable Accounting Software For Startups?

Look for software with transparent pricing and no hidden fees. Consider cloud-based options to avoid expensive installations. Free trials help assess usability and features. Prioritize software that offers essential tools without unnecessary extras, ensuring cost-effectiveness without sacrificing functionality.

Can Accounting Software Help With Tax Compliance?

Yes, most accounting software includes tax calculation and filing features. They update tax rates automatically, ensuring accuracy. Some offer integration with tax agencies for direct filing. This reduces errors and saves time during tax season.

Is Cloud-based Accounting Software Better For Small Businesses?

Cloud-based software offers accessibility from anywhere and automatic updates. It provides data backup and security managed by providers. This option reduces IT costs and supports collaboration among team members. It’s ideal for small businesses needing flexibility and scalability.

Conclusion

Choosing the right accounting software helps your small business run smoothly. Focus on features that fit your needs and budget. Easy-to-use software saves time and reduces mistakes. Think about customer support and software updates too. Take your time to compare options before deciding.

The right tool makes managing money less stressful. Keep your business growing with smart financial choices. Simple steps lead to better accounting and success.