QuickBooks is used for managing business finances. It tracks income, expenses, and invoices.

QuickBooks is a popular accounting software for businesses. It helps with bookkeeping tasks and financial management. Users can track their income and expenses with ease. The software generates invoices and manages payroll. QuickBooks also helps with tax preparation. It provides financial reports to understand business health.

Small and medium-sized businesses benefit the most. The software is user-friendly and saves time. QuickBooks can be used on both desktops and online. It is a valuable tool for efficient financial management.

Credit: www.alphaservesp.com

Introduction To Quickbooks

QuickBooks is a popular accounting software developed by Intuit. It helps businesses manage their finances. QuickBooks offers a range of tools. These tools simplify invoicing, payroll, and tracking expenses.

Brief History

QuickBooks was launched in 1983 by Intuit. It quickly became a favorite among small businesses. Initially, it was a desktop application. Later, Intuit introduced QuickBooks Online. This web-based version made accounting more accessible.

The software evolved over the years. Intuit added features such as inventory tracking and cloud storage. Today, QuickBooks is a comprehensive financial management tool.

User Demographics

QuickBooks is used by diverse groups. These include small business owners, freelancers, and accountants. Here is a breakdown of its primary users:

| User Type | Percentage |

|---|---|

| Small Businesses | 60% |

| Freelancers | 25% |

| Accountants | 15% |

Small businesses find QuickBooks invaluable. It simplifies bookkeeping tasks. Freelancers appreciate its invoicing and expense tracking features. Accountants use it to manage multiple clients’ finances.

QuickBooks is user-friendly. It is suitable for people with little accounting knowledge. Its interface is intuitive, making financial management easy.

- Simple to use

- Comprehensive features

- Affordable

QuickBooks continues to evolve. Intuit regularly updates the software. This ensures it meets the changing needs of its users.

Accounting Made Simple

QuickBooks is a popular accounting software. It helps businesses manage their finances. It’s user-friendly and suitable for all business sizes. With QuickBooks, accounting becomes simple and efficient.

Automated Bookkeeping

QuickBooks offers automated bookkeeping. It records transactions automatically. This saves time and reduces errors. You can sync bank accounts with QuickBooks. This ensures accurate financial records.

With automated bookkeeping, you can:

- Track sales and income

- Generate invoices

- Manage bills and expenses

QuickBooks updates your books in real-time. This keeps your financial data up-to-date. You can focus on growing your business.

Expense Tracking

Expense tracking is crucial for any business. QuickBooks makes expense tracking easy. You can link your credit cards and bank accounts. This allows QuickBooks to track expenses automatically.

Using QuickBooks, you can:

- Monitor spending

- Set budgets

- Generate expense reports

QuickBooks also categorizes expenses. This helps in understanding where your money goes. You can make informed financial decisions.

Here’s a quick summary of QuickBooks features:

| Feature | Description |

|---|---|

| Automated Bookkeeping | Records transactions and syncs bank accounts |

| Expense Tracking | Tracks and categorizes expenses |

Financial Reporting

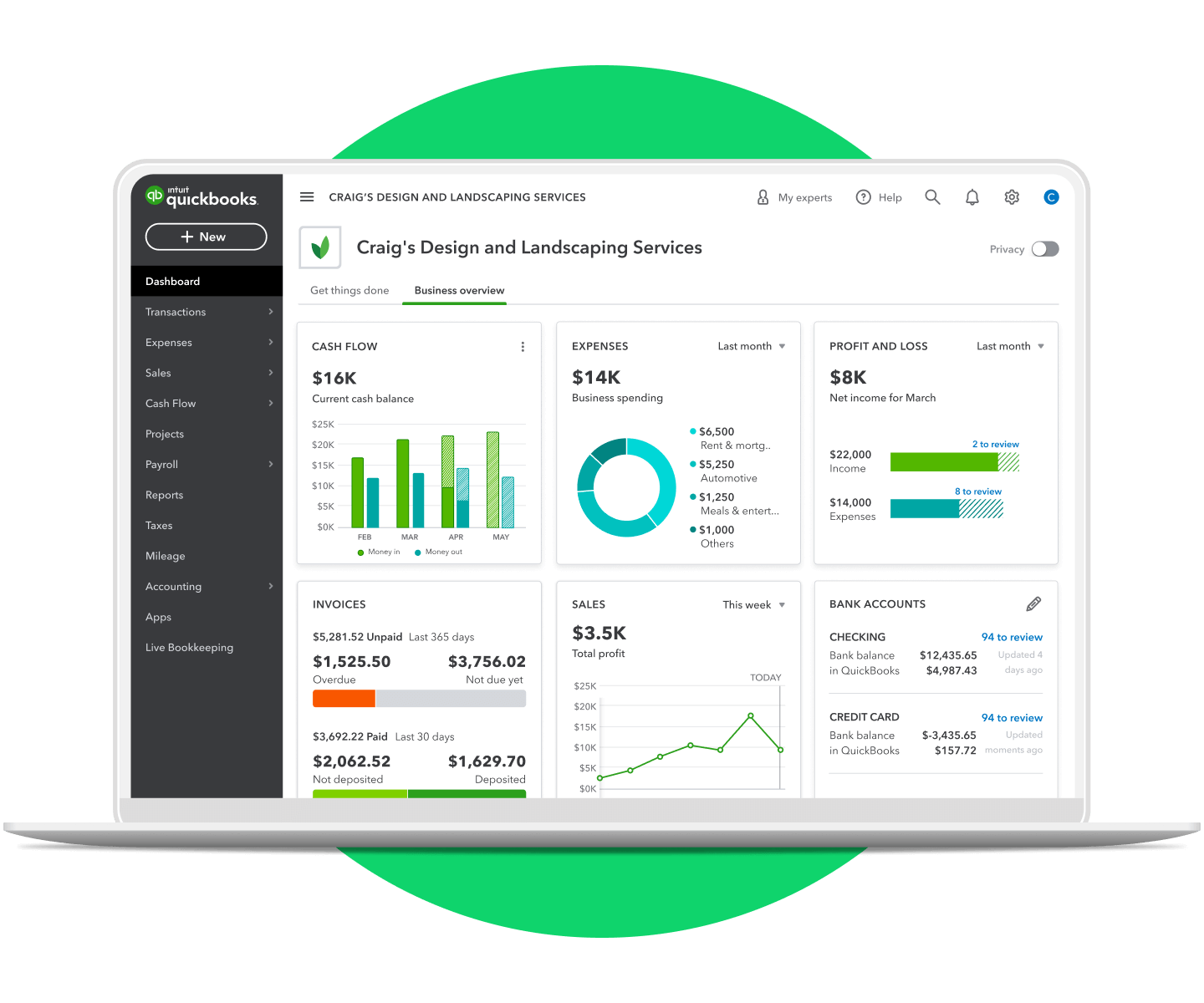

QuickBooks is a powerful tool for financial reporting. It helps businesses understand their financial health. It offers various features to generate accurate and detailed reports.

Custom Reports

With QuickBooks, you can create custom reports tailored to your needs. You can choose which data to include and how to display it. This flexibility helps you focus on the most relevant information.

- Choose specific data fields

- Filter data by date, customer, or vendor

- Adjust the layout and format

Creating custom reports helps you monitor specific aspects of your business. You can track sales trends, expenses, and profitability with ease.

Real-time Data

QuickBooks offers real-time data access. This feature keeps your financial reports up-to-date. You can make informed decisions based on the latest information.

Real-time data helps you:

- Monitor cash flow

- Track expenses and income

- Analyze financial performance

Having access to real-time data ensures you stay on top of your finances. You can quickly identify any issues and address them promptly.

| Feature | Benefit |

|---|---|

| Custom Reports | Tailored insights for better decision-making |

| Real-time Data | Up-to-date information for accurate analysis |

Tax Preparation

Tax preparation can be a daunting task for many individuals and businesses. QuickBooks simplifies this process with its comprehensive features designed to manage and streamline tax-related tasks. With QuickBooks, you can easily track income, expenses, and deductions, ensuring that you are fully prepared for tax season.

Tax Calculations

QuickBooks automates the process of calculating taxes. It accurately tracks your financial transactions throughout the year. This means you don’t have to worry about manual calculations. The software helps in identifying tax-deductible expenses. It also categorizes them correctly. QuickBooks provides detailed reports that help in understanding your tax obligations. These reports are essential for accurate tax filing. You can also customize these reports to suit your specific needs.

Filing Assistance

QuickBooks offers assistance with filing your taxes. It integrates with popular tax preparation software. This integration makes the filing process seamless. You can export all your financial data directly to the tax software. This reduces the chances of errors. Additionally, QuickBooks provides step-by-step guidance for filing taxes. This ensures you don’t miss any important steps. The software also reminds you of upcoming tax deadlines. This helps you stay on top of your tax responsibilities.

Payroll Management

QuickBooks is a powerful tool for Payroll Management. It helps businesses handle employee payments and tax withholding efficiently. This section explains how QuickBooks supports these crucial tasks.

Employee Payments

QuickBooks simplifies the process of managing employee payments. You can easily set up a payroll schedule. This ensures your employees get paid on time.

- Set up direct deposit

- Track employee hours

- Calculate paychecks automatically

QuickBooks also allows you to create and print paychecks. You can choose to pay employees with checks or direct deposit.

Tax Withholding

Tax withholding can be complex, but QuickBooks makes it easier. It calculates the correct amount of taxes to withhold. This includes federal, state, and local taxes.

QuickBooks updates tax rates automatically. This keeps your payroll compliant with the latest regulations.

It also generates important tax forms like W-2s and 1099s. These forms are essential for both your business and employees.

| Feature | Benefit |

|---|---|

| Automatic Calculations | Reduces errors in tax withholding |

| Tax Form Generation | Simplifies tax season for businesses |

Using QuickBooks for payroll helps you save time and avoid mistakes. It ensures your payroll processes are smooth and accurate.

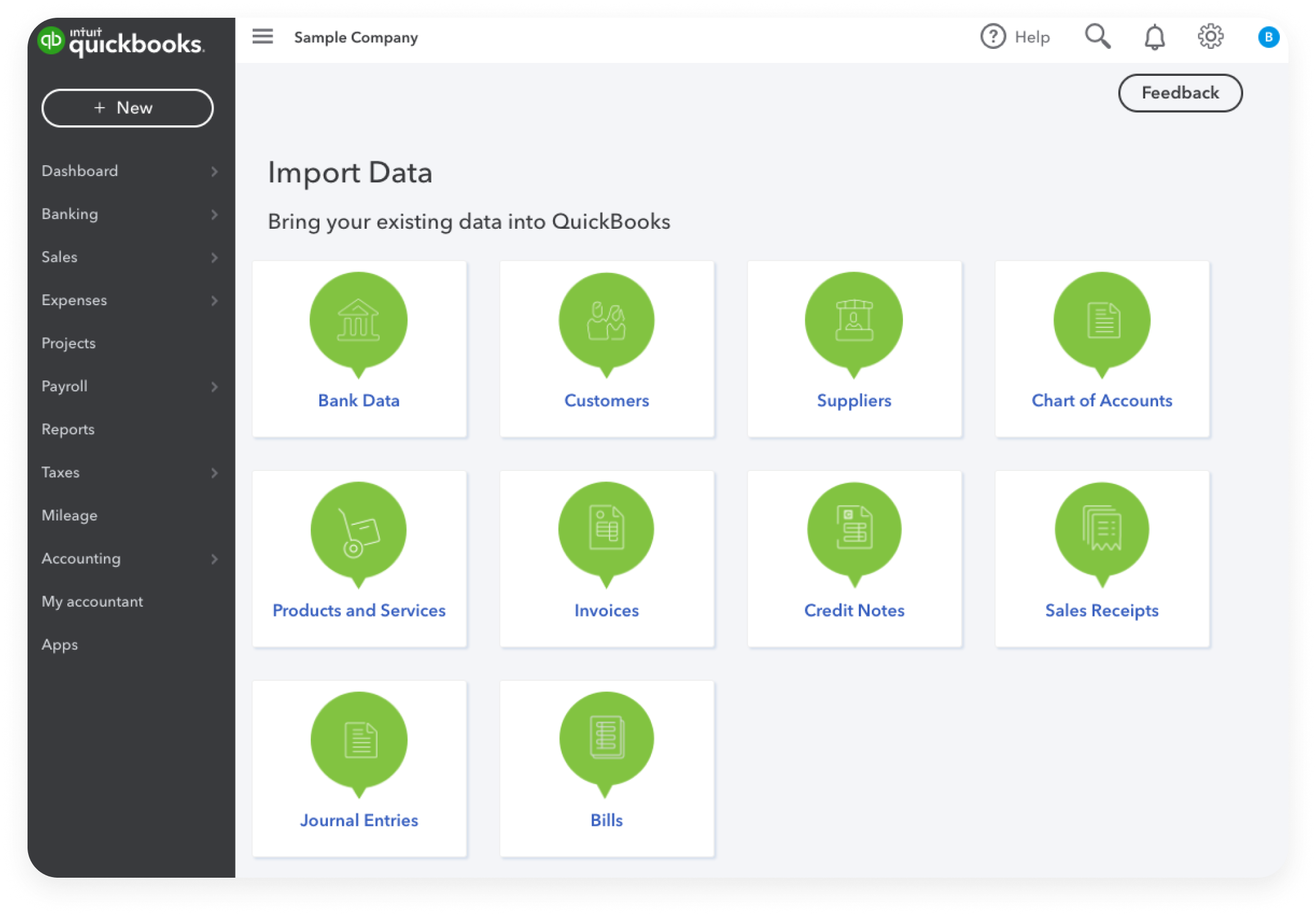

Credit: quickbooks.intuit.com

Invoicing And Payments

QuickBooks is a powerful tool for managing invoicing and payments. It helps businesses streamline their financial operations. This section explains how QuickBooks aids in creating invoices and processing payments efficiently.

Custom Invoices

With QuickBooks, you can create custom invoices that fit your brand. It allows you to add your logo, choose fonts, and set colors. You can also include detailed descriptions, itemized lists, and payment terms. Here’s a quick overview of what you can customize:

- Logo

- Fonts

- Colors

- Payment terms

- Itemized lists

Creating professional invoices has never been easier. This feature saves time and ensures consistency.

Payment Processing

QuickBooks simplifies payment processing for businesses. It offers multiple payment options, making it easy for clients to pay. You can accept credit cards, bank transfers, and online payments. This flexibility improves your cash flow.

Here are the main payment methods supported:

| Payment Method | Benefits |

|---|---|

| Credit Cards | Fast and secure |

| Bank Transfers | Direct and reliable |

| Online Payments | Convenient and easy |

QuickBooks also tracks payment statuses. You can see who has paid and who hasn’t. This helps you follow up on unpaid invoices promptly.

Inventory Management

Inventory Management is a crucial aspect of any business that deals with products. QuickBooks offers robust inventory management features that help businesses keep track of their stock, streamline order fulfillment, and manage inventory costs efficiently.

Stock Tracking

QuickBooks makes stock tracking simple and effective. You can monitor stock levels in real-time. This helps avoid stockouts and overstock situations.

- Track inventory quantities

- Monitor stock levels

- Set reorder points

QuickBooks also allows you to generate detailed reports. These reports provide insights into inventory trends. This helps in making informed decisions.

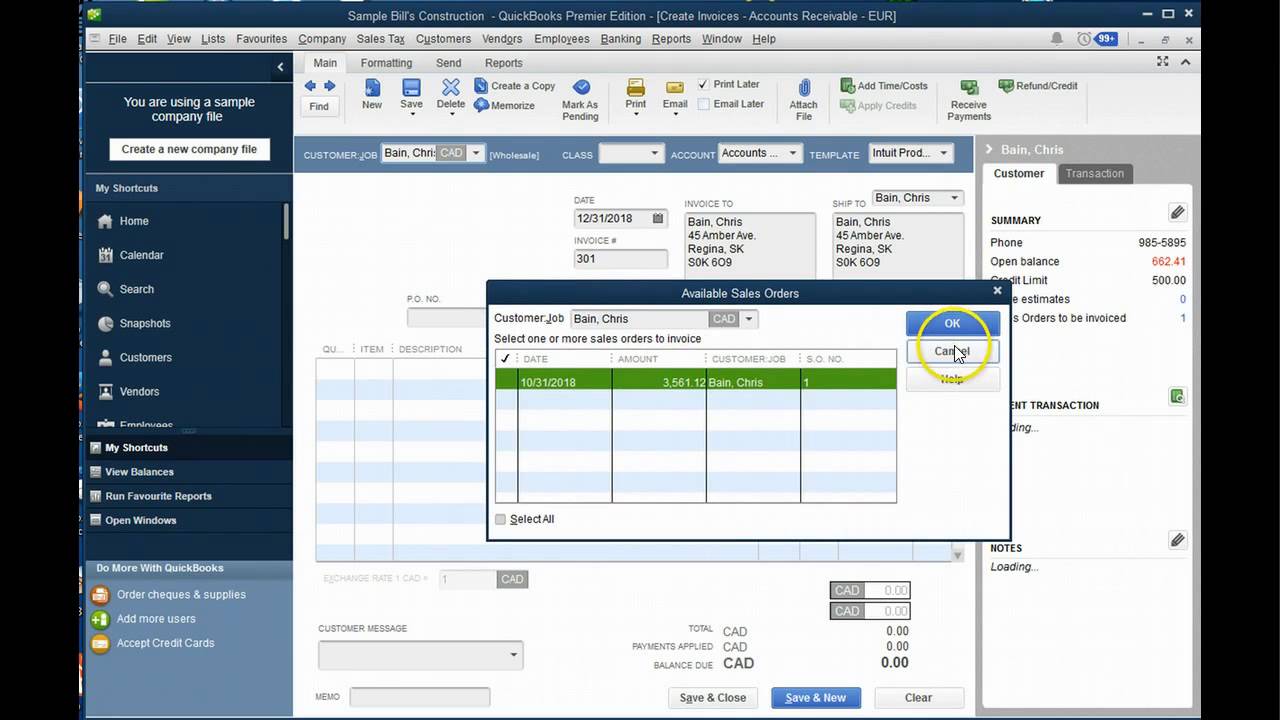

Order Fulfillment

QuickBooks streamlines the order fulfillment process. It helps you manage sales orders efficiently. You can track the status of each order from start to finish.

- Process sales orders

- Track order status

- Manage backorders

The system also allows you to create packing slips and invoices. This ensures a smooth and professional order fulfillment process.

| Feature | Benefit |

|---|---|

| Real-time Stock Tracking | Avoid stockouts and overstock |

| Order Status Tracking | Efficient order management |

| Detailed Reports | Informed decision making |

With these features, QuickBooks makes inventory management easy and effective. This can help businesses save time and reduce costs.

Credit: m.youtube.com

Mobile Accessibility

QuickBooks offers robust mobile accessibility features. These features allow users to manage their finances on the go. The QuickBooks mobile app ensures you stay connected to your business. This seamless integration helps you track expenses, send invoices, and more.

Mobile App Features

The QuickBooks mobile app is packed with features. These features provide convenience and efficiency:

- Expense Tracking: Snap photos of receipts and categorize expenses.

- Invoicing: Create, send, and track invoices from your phone.

- Payments: Accept payments and get paid faster.

- Reports: Generate financial reports and track performance.

- Notifications: Receive alerts for important activities.

Remote Access

QuickBooks’ remote access feature is a game-changer. It allows you to access your financial data anytime, anywhere. This flexibility ensures you never miss important updates:

- Secure Login: Access your data securely from any device.

- Real-Time Sync: Changes are updated in real-time across devices.

- Collaboration: Share access with your accountant or team members.

- Cloud Storage: Your data is stored safely in the cloud.

With QuickBooks’ mobile accessibility, you can run your business smoothly. The mobile app features and remote access capabilities keep you connected. This ensures you have control over your finances at all times.

Integration With Other Tools

QuickBooks is not just an accounting software. It integrates with many other tools. This feature makes it more powerful and useful for businesses. Let’s explore how QuickBooks integrates with other tools.

Third-party Apps

QuickBooks connects with many third-party apps. These apps help expand its functionality. For example, it integrates with payment processors like PayPal and Square. It also connects with CRM tools like Salesforce. This integration helps in managing both sales and finances from one place.

| App Type | Examples |

|---|---|

| Payment Processors | PayPal, Square |

| CRM Tools | Salesforce, HubSpot |

| Inventory Management | TradeGecko, Fishbowl |

Seamless Data Sync

QuickBooks allows for seamless data sync with other tools. This means data flows smoothly between QuickBooks and other software. For instance, inventory levels update automatically with inventory management tools. This saves time and reduces errors.

Here are some benefits of seamless data sync:

- Real-time updates

- Reduced manual data entry

- Fewer errors

- Improved efficiency

With these integrations, businesses can streamline their operations. QuickBooks makes managing finances easier and more efficient.

Frequently Asked Questions

What Is Quickbooks Used For?

QuickBooks is used for managing business finances, including tracking income and expenses. It helps with invoicing, payroll, and generating financial reports.

How Does Quickbooks Help Small Businesses?

QuickBooks helps small businesses by simplifying accounting tasks. It offers tools for tracking sales, expenses, and profits. It also provides easy tax preparation.

Can Quickbooks Manage Payroll?

Yes, QuickBooks can manage payroll. It automates payroll processing, calculates taxes, and ensures compliance with tax laws. It also generates payroll reports.

Is Quickbooks Suitable For Freelancers?

Yes, QuickBooks is suitable for freelancers. It helps track income, expenses, and manage invoices. It also simplifies tax preparation and financial reporting.

Conclusion

QuickBooks simplifies financial tasks for businesses of all sizes. It’s user-friendly and efficient. Manage invoices, expenses, and payroll with ease. QuickBooks also offers valuable insights and reports. This tool helps businesses stay organized and financially healthy. Consider QuickBooks for your business to streamline accounting processes.