Choosing the right accounting software can make a huge difference in how smoothly your business runs. If you’re in the UK and wondering which accounting software is mostly used, you’re in the right place.

This isn’t just about picking a tool; it’s about finding a solution that saves you time, reduces stress, and helps your business grow. By the end of this article, you’ll know exactly which options top the list and why they work best for businesses like yours.

Ready to find the perfect fit for your accounting needs? Let’s dive in.

Market Trends In Uk Accounting Software

The UK accounting software market shows clear trends shaped by business needs and technology. Companies choose software that fits their size, industry, and budget. This section explores current usage, growth factors, and regulatory effects.

Current Usage Patterns

Small and medium businesses mostly use cloud-based accounting software. It offers easy access and low costs. Popular choices include QuickBooks, Xero, and Sage. Many users prefer software with invoicing, payroll, and tax features. Desktop solutions remain for large firms with complex needs.

Growth Drivers

Cloud technology drives market growth. It simplifies updates and backups. Mobile access helps business owners manage accounts anywhere. Automation reduces manual tasks and errors. The rise of freelancers and startups also increases demand for simple software. Affordable pricing plans attract more users.

Impact Of Regulations

UK tax laws strongly influence software features. VAT rules require accurate reporting and submissions. Making Tax Digital (MTD) mandates digital record-keeping for many businesses. Software providers update products to meet these rules quickly. Compliance keeps accounting smooth and avoids penalties.

Top Accounting Software In The Uk

Choosing the right accounting software is key for businesses in the UK. Many options are designed to simplify tasks like invoicing, payroll, and tax reporting. This section covers the top accounting software widely used across the UK.

Each software has unique features suited for different business needs. Understanding these options helps find the best fit for your company.

Xero

Xero is popular for its user-friendly design. It works well for small to medium-sized businesses. The software offers real-time bank feeds and easy invoice creation. It supports VAT calculations, making tax time simpler. Many UK businesses choose Xero for its cloud-based access.

Quickbooks Online

QuickBooks Online is trusted by many UK companies. It offers tools for managing expenses and sales. The software helps track VAT and auto-updates tax rates. It also allows easy collaboration with accountants. QuickBooks suits businesses needing flexible accounting solutions.

Sage Business Cloud

Sage Business Cloud is a strong choice for growing businesses. It provides payroll and invoicing features. The software complies with UK tax laws and supports Making Tax Digital. Sage offers scalable plans to match business growth. It integrates well with other business tools.

Freeagent

FreeAgent targets freelancers and small firms. It simplifies expense tracking and time recording. The software automates VAT submissions to HMRC. It offers clear financial reports and easy invoicing. Many UK freelancers trust FreeAgent for its simplicity.

Zoho Books

Zoho Books is known for affordability and features. It manages invoices, expenses, and bank reconciliation. The software supports UK VAT and tax filing. Zoho Books connects with other Zoho apps for business management. It suits small businesses needing a cost-effective solution.

Features That Matter Most

Choosing the right accounting software depends on key features. These features make the software easy and efficient to use. They help businesses save time and avoid mistakes. The most important features focus on usability, automation, integration, and security. Each plays a vital role in managing finances smoothly.

User-friendly Interface

A simple and clear interface helps users work faster. Easy navigation reduces errors and confusion. Visual dashboards show important data at a glance. This feature is important for small business owners and beginners. It saves time by making tasks straightforward and quick.

Automation Capabilities

Automation handles repetitive tasks like invoicing and bank feeds. It reduces manual work and human errors. Automatic calculations ensure accuracy in reports and taxes. This feature frees up time to focus on business growth. Regular updates improve efficiency and keep software reliable.

Integration Options

Good software connects with other business tools smoothly. It links with payroll, CRM, and payment systems. This connection saves time by syncing data automatically. It avoids double entry and reduces mistakes. Flexible integration supports growing business needs and changes.

Compliance And Security

Software must follow UK tax laws and regulations. It should update regularly to reflect legal changes. Strong security protects sensitive financial data from theft. Features like data encryption and backups are essential. Compliance and security build trust and protect business reputation.

Credit: www.1training.org

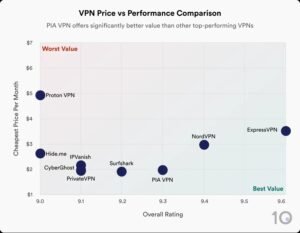

Pricing And Plans Comparison

Choosing the right accounting software depends heavily on its pricing and plans. Different software offers various subscription types, trial options, and features. Understanding these can help businesses pick what suits their needs and budget best.

This section breaks down the common pricing and plans seen in UK accounting software.

Subscription Models

Most accounting software uses monthly or yearly subscriptions. Monthly plans offer flexibility but may cost more over time. Yearly plans often come with discounts, saving money for long-term users. Some software charges based on the number of users or businesses managed. Others include extra fees for advanced features or support.

Free Trials And Demos

Free trials let users test software without paying. These trials usually last from 14 to 30 days. Demos show how the software works but may limit access to features. Both help businesses see if the software fits before buying. Many UK providers offer these options to build trust.

Value For Money

Value depends on features, ease of use, and support included. Cheaper plans might miss important tools or limit access. More expensive plans often provide full features and faster support. Businesses should match their needs with plan benefits. Saving money is good, but missing key features can cost more later.

Choosing Software Based On Business Size

Choosing the right accounting software depends largely on the size of your business. Different sizes have different needs and budgets. The right software helps manage finances smoothly and saves time. It also supports growth by offering the right features at the right scale.

Freelancers And Sole Traders

Freelancers and sole traders need simple, easy-to-use software. They usually require basic tools for invoicing and expense tracking. Affordable options with straightforward interfaces work best. Software like QuickBooks Self-Employed or FreeAgent fits these needs well. These tools help keep accounts organized without complex features.

Small And Medium Enterprises

Small and medium businesses need more robust software. Features like payroll, tax management, and reporting become important. Cloud-based software offers flexibility and easy access. Xero and Sage are popular choices in this category. They provide scalable options to handle growing transactions and staff.

Large Corporations

Large corporations require advanced software with extensive features. Integration with other business systems is crucial. Software must handle multiple users, departments, and compliance regulations. Solutions like SAP Business One or Oracle NetSuite serve these needs. They support complex financial operations and detailed reporting.

Credit: www.wolterskluwer.com

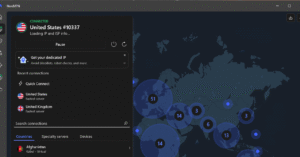

Cloud Vs Desktop Solutions

Choosing the right accounting software is key for many UK businesses. The main choice often lies between cloud and desktop solutions. Each type has unique features and benefits. Understanding these can help businesses decide what suits their needs best.

Advantages Of Cloud Accounting

Cloud accounting runs on the internet. Users can access it from any device with a web connection. This flexibility helps business owners work anywhere. Updates happen automatically, so users get the latest features. Data is stored safely on remote servers. Many cloud services offer real-time collaboration. This allows teams to work together easily. Cloud solutions often come with lower upfront costs. They scale well for growing businesses. Monthly subscriptions replace large one-time purchases. This makes budgeting simpler for small companies.

When To Choose Desktop Software

Desktop software installs directly on a computer. It works without needing internet access. This can be useful in areas with poor connectivity. Data stays on the local device, offering more control. Some users prefer desktop options for security reasons. Complex accounting tasks may run faster on desktop software. Licensing fees are usually one-time payments. This can save money over time. Businesses with stable IT setups often choose desktop solutions. They value having software available offline at all times.

Customer Support And Community

Customer support and community play a big role in choosing accounting software. Good support helps users solve problems fast. A strong community shares tips and advice. Both make the software easier to use and more reliable.

Support Channels

Most popular UK accounting software offers several support channels. Phone support is common for quick help. Email support suits less urgent questions. Live chat provides instant answers during working hours. Some software also includes a help center with articles and guides. This variety helps users get help in their preferred way.

User Communities And Resources

User communities help people connect and learn from each other. Forums allow users to ask questions and share solutions. Online groups on social media platforms offer real-time discussions. Many software companies host webinars and training sessions. These resources help users improve skills and solve issues without waiting for support.

Credit: www.techdonut.co.uk

Future Outlook For Uk Accounting Software

The future of accounting software in the UK looks promising and full of change. More businesses rely on digital tools to manage their finances. Software providers keep improving features to meet new needs. This means UK accounting software will become smarter and more user-friendly.

New technologies will shape how accountants work. They will help save time and reduce errors. Small and medium businesses will have better access to powerful tools. The market for accounting software will also grow and shift in many ways.

Emerging Technologies

Artificial intelligence plays a big role in future software. AI can analyze data faster than humans. It helps spot mistakes and suggest corrections. Machine learning allows software to improve over time. Cloud computing lets users access software anywhere, anytime. This trend is strong in the UK market. Mobile apps will become more common for accounting tasks. Automation will reduce manual data entry. It frees up time for more important work.

Predicted Market Changes

The UK market will see more competition among software providers. New companies may enter with fresh ideas. Existing firms will update their products regularly. Subscription models will stay popular for affordable access. Integration with other business tools will increase. Users expect seamless connection with banks and payment systems. Security and data privacy will gain more focus. Regulations may require software to adapt quickly. Overall, UK accounting software will become more efficient and easier to use.

Frequently Asked Questions

What Is The Most Popular Accounting Software In The Uk?

Xero and QuickBooks are the most popular accounting software in the UK. They offer cloud-based solutions with easy invoicing and bank integration. Many UK businesses prefer these for their user-friendly features and compliance with UK tax laws.

Which Accounting Software Suits Small Uk Businesses Best?

QuickBooks and Sage are ideal for small UK businesses. They provide simple bookkeeping, VAT management, and payroll support. These platforms help small businesses stay organized and meet HMRC requirements efficiently.

Are Uk Accounting Software Compliant With Hmrc Standards?

Yes, leading UK accounting software like Xero and Sage are HMRC compliant. They support Making Tax Digital (MTD) requirements, ensuring seamless VAT submissions and accurate record-keeping for UK businesses.

How Much Does Uk Accounting Software Typically Cost?

UK accounting software pricing varies from £10 to £30 per month. Costs depend on features, user numbers, and add-ons. Many providers offer free trials to help businesses choose the right plan.

Conclusion

Choosing the right accounting software helps manage your finances well. Many businesses in the UK prefer popular options like QuickBooks and Xero. These tools offer easy features for small and large companies alike. Your choice depends on your specific needs and budget.

Try to find software that saves time and reduces errors. Good accounting software makes your work simpler and more organized. Remember, the best tool is one you feel comfortable using every day.